Hi88 đăng nhập là một thao tác vô cùng quan trọng mà mọi người chơi đều cần nắm được. Các bước đăng nhập này tuy không quá phức tạp nhưng một số anh em vẫn chưa biết cách thực hiện. Cùng cayman27.com.ky tìm hiểu thông tin từ bài viết chia sẻ dưới đây để biết cách đăng nhập vào nhà cái nhé!

Khám phá đôi nét thông tin cơ bản về nhà cái Hi88

Nhà cái Hi88 là một đơn vị đang cung cấp rất nhiều hoạt động cá cược đỉnh cao. Tại đây anh em sẽ được trải nghiệm lần lượt qua nhiều tựa game hấp dẫn. Ngay từ khi hoạt động sân chơi này đã được cấp phép bởi tổ chức Costa Rica. Do đó bạn hoàn toàn có thể yên tâm mỗi khi cá cược tại nhà cái này.

Khi tham gia vào nhà cái Hi88 đăng nhập được xem là một khâu bắt buộc mà bạn cần nắm được. Các bước đăng nhập này không quá khó khăn, đa phần người chơi đều có thể thực hiện được. Đăng nhập xong anh em sẽ được trải nghiệm lần lượt nhiều tựa game hấp dẫn tại nhà cái như:

- Nổ hũ.

- Casino.

- Game bài.

- Cá cược thể thao.

- Bắn cá.

- Xổ số.

Tất cả những sảnh game này đều có nhiều trò chơi và phần thưởng vô cùng hấp dẫn. Ngoài ra nhà cái cũng luôn triển khai rất nhiều chương trình khuyến mãi lớn. Người chơi vừa có thể tham gia cá cược lại vừa được hưởng các ưu đãi này.

Hướng dẫn tham gia vào Hi88 đăng nhập qua 3 cách

Để tham gia trải nghiệm được vào nhà cái này trước hết bạn cần biết cách đăng nhập. Dưới đây là 3 cách đơn giản mà anh em có thể tham khảo như:

Đăng nhập từ link của trang chủ

Việc đăng nhập vào nhà cái bằng đường link truy cập vào trang chủ là một cách phổ biến nhất. Đăng nhập vào đường link này người chơi sẽ được sử dụng đầy đủ các dịch vụ do nhà cái cung cấp.

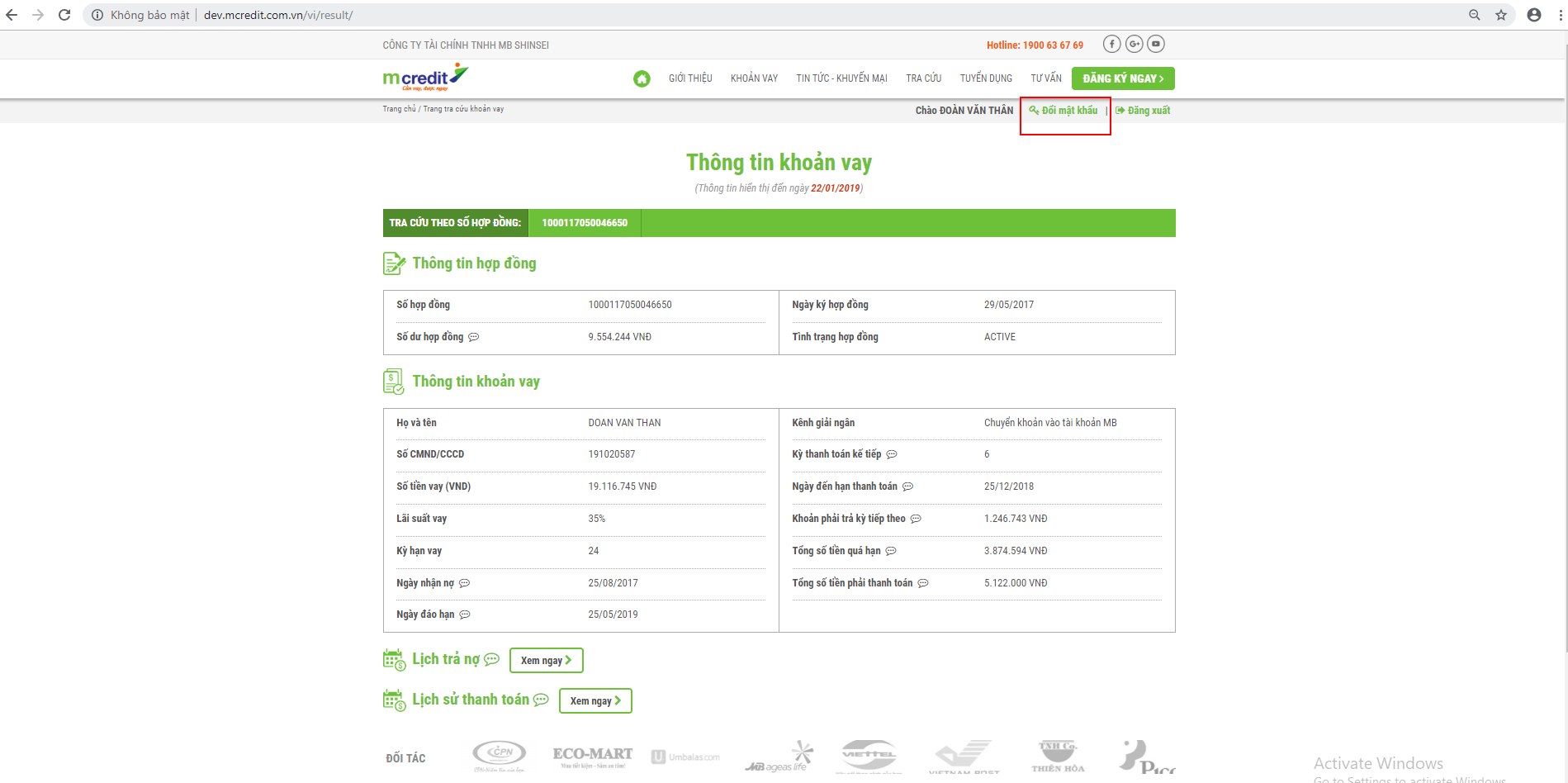

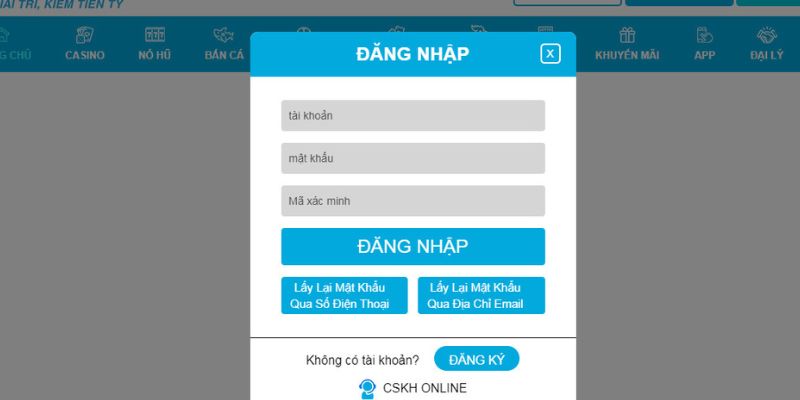

Sau khi chọn được đường link uy tín vào nhà cái, tại giao diện bạn sẽ thấy nút “Đăng nhập”. Người chơi sẽ ấn chọn vào nút này và điền vào thông tin tài khoản của bạn. Điền xong ấn chọn vào “đăng nhập” giao diện sẽ chuyển hướng đến trang chủ nhà cái.

Khi tham gia vào Hi88 đăng nhập bằng cách này bạn sẽ không cần tìm kiếm link hay sử dụng ứng dụng. Người chơi chỉ cần truy cập vào trang chủ nhà cái và thực hiện các thao tác tại đây.

Tham gia vào Hi88 đăng nhập bằng link dự phòng

Ngoài những cách trên thì bạn cũng có thể đăng nhập vào nhà cái bằng đường link dự phòng. Cụ thể cách đăng nhập này được thực hiện theo các bước hướng dẫn sau đây:

- Bước 1: Người chơi hãy tìm kiếm các đường link dự phòng của nhà cái Hi88 từ những nguồn uy tín.

- Bước 2: Chọn vào một trong số những đường link dự phòng chất lượng, cần phải đảm bảo link không bị chặn hoặc bị giả mạo nhà cái.

- Bước 3: Nhập vào đó địa chỉ link dự phòng vào thanh địa chỉ ở phía trên của trình duyệt web rồi nhấn Enter.

- Bước 4: Lúc này bạn sẽ truy cập được vào nhà cái Hi88 đăng nhập bằng link dự phòng. Trang web của Hi88 sẽ được hiển thị ở trên màn hình của người chơi. Bạn có thể đăng nhập vào nhà cái bằng tài khoản của mình đã đăng ký trước đó.

Lưu ý: Để đảm bảo được sự an toàn cho thông tin của các game thủ khi cá cược. Bạn cần chú ý không đăng nhập qua những link dự phòng không rõ nguồn gốc. Người chơi chỉ nên thực hiện cách đăng nhập vào nhà cái này trong trường hợp link chính không vào được.

Đăng nhập vào Hi88 qua app

Ngoài cách trên bạn cũng có thể sử dụng cách đăng nhập thông qua app do nhà cái phát hành ra. Đây cũng là một cách rất phổ biến mang đến cho người dùng nhiều lợi ích. Cách tham gia vào Hi88 đăng nhập bằng app này sẽ giúp bạn có trải nghiệm mượt mà hơn. Ứng dụng sẽ cho phép người dùng có thể chơi game cá cược được mọi lúc mọi nơi. Để đăng nhập được bạn thực hiện theo các bước sau đây:

- Bước 1: Người chơi hãy tìm link truy cập vào trang chủ của Hi88.

- Bước 2: Sau đó bạn hãy tìm và nhấn chọn vào mục tải App ở phía trên của thanh điều hướng của trang web.

- Bước 3: Tiếp đến hãy lựa chọn phiên bản ứng dụng phù hợp với hệ điều hành mà máy của bạn đang có.

- Bước 4: Cuối cùng người chơi hãy mở ứng dụng này ra và tham gia vào nhà cái Hi88 và đăng nhập trong vài phút. Bạn chỉ cần đăng nhập vào bằng tài khoản đã được đăng ký trên website của nhà cái.

Hiện tại ứng dụng của nhà cái đang hỗ trợ cho 2 hệ điều hành đó là IOS và Android. Do đó người chơi cần phải tải được file APK hoặc file thích hợp với dòng máy của mình đang dùng. Bằng cách đăng nhập này người chơi sẽ trải nghiệm dễ dàng được các trò chơi của nhà cái. Bạn chỉ cần có một chiếc điện thoại thông minh có kết nối mạng là được.

Hi88 đăng nhập cần lưu ý những gì?

Khi đăng nhập vào nhà cái trên các thiết bị lạ mà quên mất việc đăng xuất hoặc vô tình lưu lại thông tin. Việc này sẽ đồng nghĩa bạn đang tự mình để lộ thông tin tài khoản game của mình. Như vậy dữ liệu và cả tiền trong tài khoản của bạn sẽ bị đánh cắp.

Do đó, khi đăng nhập vào nhà cái bạn cần lưu ý một số điểm chính như:

- Nên hạn chế tối đa việc Hi88 đăng nhập tài khoản của mình trên hệ thống máy tính lạ. Nếu như có đăng nhập bạn nên xóa lịch sử truy cập đồng thời cũng không được để cho hệ thống lưu mật khẩu một cách tự động.

- Người chơi cũng tuyệt đối không nên tiết lộ mật khẩu tài khoản của mình cho bất kỳ ai để tránh được những rủi ro sau này.

- Mật khẩu bạn đang nhập cũng không nên để quá đơn giản bởi vì như vậy sẽ rất dễ bị hack.

Trên đây là thông tin về Hi88 đăng nhập mà chúng tôi muốn gửi đến bạn đọc. Hy vọng thông qua đó bạn sẽ nắm được 3 cách để tham gia vào nhà cái Hi88 để chơi game. Nếu vẫn còn thắc mắc về những cách trên hãy liên hệ cho chúng tôi để được nhân viên hỗ trợ. Chúc bạn chơi game vui vẻ và luôn nhận được nhiều phần thưởng hấp dẫn nhé!